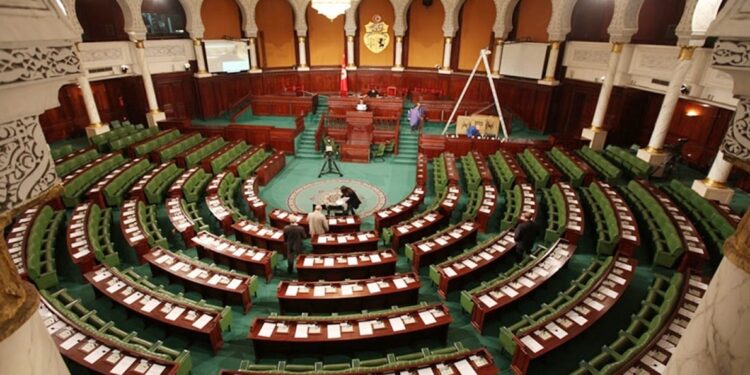

The Assembly of People’s Representatives adopted in plenary a new article revising the framework of tax advantages intended for Tunisians residing abroad.

The text, presented under number 123 (new), obtained broad approval with 103 votes in favor, against only 3 votes against and 5 abstentions. This revision takes place as part of the examination of the 2026 Finance Bill.

A tax advantage refocused on investment

The new article redefines the privileges linked to the importation and acquisition of equipment, materials and a single truck (tariff position 8704), with the aim of supporting the creation or participation in investment projects in Tunisia.

Tunisians residing abroad would thus benefit from an exemption from import duties and taxes, as well as a suspension of VAT. Depending on the case, consumption duties and duties levied on turnover would also be suspended when purchasing equipment on the local market.

Concerning trucks, the system provides for a payment reduced to 10% of the value of taxes and fees normally payable.

Stricter eligibility conditions

The text specifies that these tax advantages can only be granted once every five years, with the exception of those linked to trucks.

The exemption is also conditional on the age of the vehicles concerned:

- automotive equipment falling under tariff headings 8701 to 8705 must be less than five years old from their first entry into circulation;

- only agricultural tractors (heading 8701) can be imported up to ten years old.

These restrictions aim to limit the importation of equipment that is too old while supporting productive projects.

The provisions of Law No. 101 remain applicable until the conditions of execution of the new article have been established by decree. This transitional period will make it possible to specify the practical arrangements and procedures for access to the new privileges.

Read also