The Central Bank of Tunisia (BCT) notes a major shift in payment methods: transactions by bills of exchange jumped 160% at the end of September 2025, while transactions by checks fell sharply. These developments, published in the “Payments in Figures” bulletin, demonstrate a profound change in the habits of users and businesses.

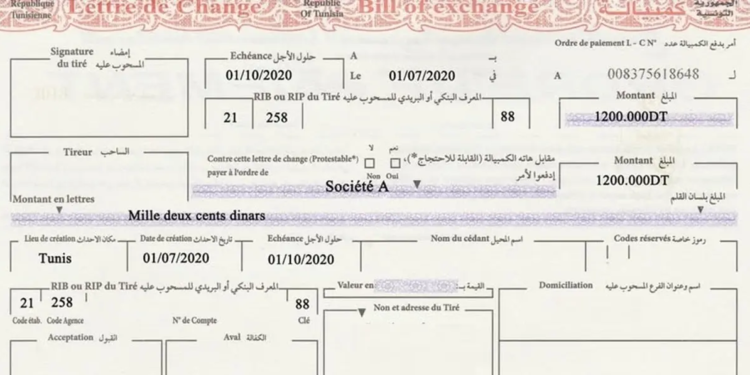

Bills of exchange booming

According to the BCT, bills of exchange reached 3.4 million operations over the first nine months of the year, totaling 39.78 billion dinars. This spectacular increase (+160%) contrasts sharply with the decline in checks, confirming increased adoption of secure digital media.

The rejection rate for these instruments remains notable: 10.2% for bills of exchange.

Massive drop in check payments

Checks recorded a net drop of 67.9%, totaling only 5.9 million operations for a volume of 40.212 billion dinars. Their rejection rate, lower than that of bills of exchange, stands at 2.2%.

This trend confirms a structural decline of the check as a preferred instrument.

Transfers, cards, ATM and electronic payments: other key figures

The BCT reports an increase in transfers, reaching 28.1 million operations (+10.2%) for a volume of 58 billion dinars.

The number of bank cards increased by 6.4%, exceeding 5.8 million cards.

On the other hand, the number of ATMs/ATMs fell slightly to 3,290 devices (-0.5%).

Electronic payments side:

- E-payment: +19% → 14.1 million transactions

- Proximity payment via TPE: +16.3% → 34.8 million transactions

- Active merchant sites: +2% → 1,148 sites

- TPE installed: +9.2% → 42.8 thousand devices

These figures confirm an accelerated transition towards dematerialized means of payment, driven by digital transformation, the extension of e-commerce and the efforts of banks to modernize transaction tools. The check now slides into the background, while bills of exchange and electronic payments take a prominent place.

Read also