A group of deputies presented a legislative text opening access to the FCR regime to certain citizens living in Tunisia. Until now reserved for Tunisians residing abroad, this tax privilege could be granted, under conditions, once in life, to Tunisian residents.

A bill intends to allow certain Tunisians residing in the country to benefit from the FCR regime, so far reserved for expatriates. This tax measure could grant unique exemption to modest citizens.

Strict eligibility conditions

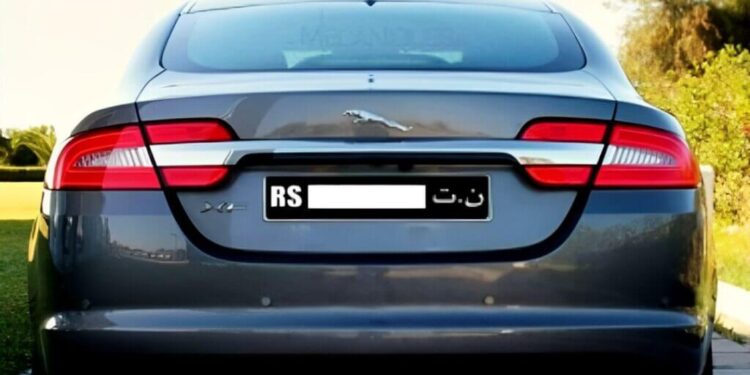

On Tuesday, July 8, 2025, twenty-two deputies submitted to the Assembly an unprecedented bill aimed at expanding access to the FCR (return franchise) regime to Tunisians residing on the national territory. This measure, currently reserved for expatriates, makes it possible to import a vehicle without paying customs, consumption or VAT rights.

The text, quickly transmitted to the Finance and Budget Commission, proposes to grant this tax privilege to any Tunisian citizen over 30 years old, residing in Tunisia, provided that not exceeding certain income thresholds. For a single person, the ceiling is fixed in the annual SMIG (around 5376 dinars per month), and for a couple, to eighteen times the SMIG (8064 dinars per month).

A unique and supervised exemption

The advantage would be allocated only once in life, without the possibility of cumulation with a previous FCR obtained as a resident abroad. Eligible vehicles should be under the age of five, weigh less than 3.5 tonnes, and be intended for personal or professional use. As with the current regime, import can be done from abroad or via the local market, with the same tax exemptions.

The bill also provides for a strict administrative supervision system, with verification of income, family and residence proof. An a posteriori check is envisaged in the event of a false declaration.

A call for broader reform

As an extension of this parliamentary initiative, tax experts also call for a broader overhaul of the scheme. The anis Ben Said tax advisor, speaking on May 16 on Express FM, pleaded for the FCR to be accessible to all Tunisians, at least once in their lives, in order to stimulate the formal economy and to lighten the charges on households. According to him, this reform could also help modernize and simplify current tax architecture.

If it is adopted, the bill of July 8 would represent a notable evolution of the FCR regime, by expanding this tax advantage to a new category of citizens, in a strict and capped regulatory framework. The coming parliamentary debate will make it possible to define the final contours.

What should we watch?

Parliamentary debates on the text will take place in the coming weeks. Pending the position of the Ministry of Finance on this partial reform of the FCR and any amendments or enlargements of the system within the framework of the finance law 2026, remember that the FCR (return franchise) regime is a customs exemption mechanism allowing Tunisians residing abroad to import goods – in particular vehicles – without paying taxes.

For the time being, this is only a bill which will only come into force in the event of adoption by the Parliament. In addition, only citizens over 30 years old, under defined income ceilings, and never benefited from the FCR are concerned.